What Other Investment Opportunity Is Inflation-Protected?

It's incredible so many of the younger generation choose to ignore the opportunity of securing a comfortable retirement. Instead, they prefer to maximise their disposable income. Why worry anyway, retirement is decades away ... right?

I cannot stress it enough ... the earlier you start contributing to a private pension, the bigger the gains you could make as you approach retirement.

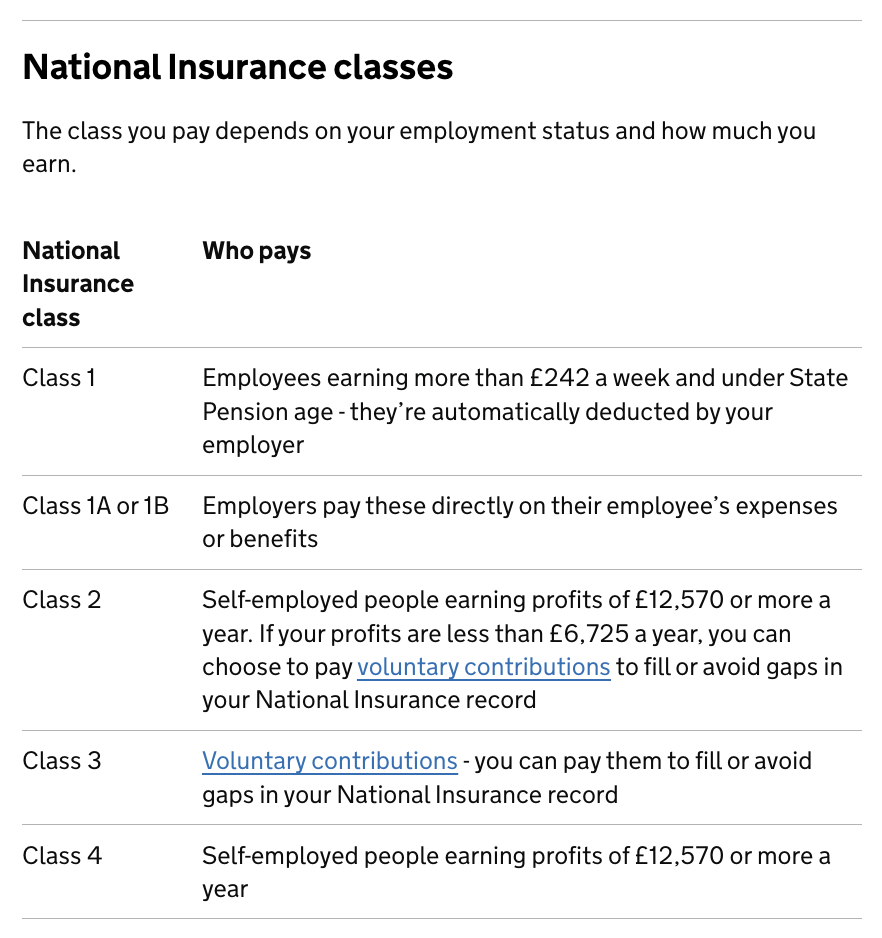

So, if your private pension pot isn't looking particularly healthy then it's important to look at your National Insurance Contributions (NICs) history. If you want to ensure that you qualify for the highest possible state pension, you must have contributed at least 35 qualifying NI years. I would recommend checking the type of NICs you pay and what they entitle you to and then seeing if you can make any additional contributions to improve on it.

Future Pension Centre Number: 0800 731 0175

Found A Gap In Your NI Contributions?

If you discover that your contributions have a gap (as far back as 2006) that would affect your entitlement to the full state pension, you may be in luck if you plug that gap before the 31st July 2023. After 31st July you will only be able to go back a maximum of 6 years.

Most importantly, the state pension is set to increase by inflation each year. Yes, your income is inflation-protected! What other investment options guarantee that?

Watch the following video ... it will show you how completing your NICs can put lots of extra money in your pocket. It could be worth thousands of pounds EVERY YEAR in your retirement!