Building Lasting Wealth

Financial freedom - a concept that ignites a burning desire in countless individuals. While various paths lead to wealth creation, savvy investors recognise property investment as a powerful and time-tested strategy.

But what sets property apart from stocks, bonds, or the latest cryptocurrency craze?

[1]

The Allure of Property:

Tangible Security and Long-Term Benefits

Unlike stocks or bonds, which represent ownership in a company or a piece of debt, property is a physical asset – a tangible investment you can see and touch.

This physical nature provides a sense of security and stability, particularly when market volatility threatens your stocks & bonds portfolio's value.

Furthermore, property acts as a hedge against inflation.

Over time, inflation erodes the purchasing power of cash. However, real estate tends to hold its value and is the reason we see house prices increasing as currency becomes weaker.

Having an asset, that historically holds its value, protects your investment with a significantly higher potential to outperform inflation in the long run.

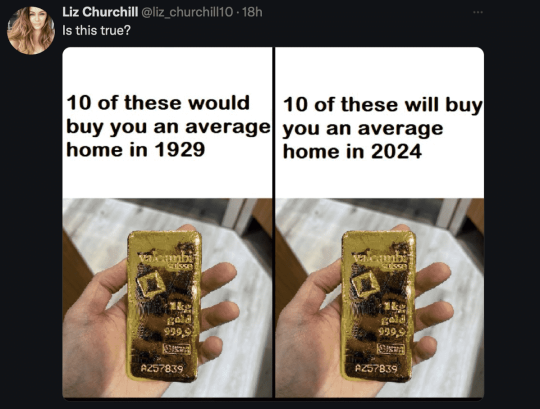

A recent 'X' (Twitter) post brought home the unsettling fact that 10kg of gold would have bought you the same average UK house in 1929 and 2024.

Why is it unsettling? Because of the incredible devaluation of fiat money.

Gold has not changed but fiat money's value has been etched away by inflation, interest rate adjustments, and printing more bank notes when a government decides/believes it's necessary to improve a country's economic situation.

Several other factors can affect a currency's value, but I will leave that to an economist to explain in more detail.

This is a perfect example of 'devaluation' and is a warning to anyone insisting on leaving money in a bank account ... you will lose money!

[2]

Beyond Appreciation:

Building Wealth Through Steady Cash Flow

Owning rental properties provides a dependable source of income through regular rent payments.

This cash flow serves several critical functions. It can cover your mortgage payments, generate additional income beyond your salary, and fuel further investment in your portfolio, allowing you to snowball your wealth.

Property investment is always considered a long-term commitment. One significant reason for growing a portfolio rather than selling property is taxation.

For as long as you own a rental property, you are only liable to pay tax on the income it generates.

"What about Council Tax?", I hear you say. Well, in the UK it is the responsibility of the landlord to pay council tax, however, it is common for this to be offset by adjusting the rent charged.

If you decide to sell one of the houses in your rental portfolio, you will be required to pay Capital Gains Tax. In the UK, this can be 18%-28% of the appreciated value of the property since it was purchased. Should the value of the house fall below the initial purchase price, no Capital Gains Tax is due.

There are ways of reducing tax liability on properties you own. See 'Reason [5]' for methods successful property investors prefer to adopt.

[3]

Multiple Income Streams:

Maximising the Profit Potential of Property

The beauty of property investment lies in its diverse income-generating potential.

While rental income serves as the primary source of revenue, savvy investors can explore additional avenues to maximise their returns.

These strategies include:

Flipping Properties

This strategy involves purchasing a property below market value, making necessary renovations, and then selling it for a quick profit.

While riskier than a buy-and-hold approach, flipping can generate significant returns in a shorter timeframe.

Short-Term Rentals

Platforms like Airbnb allow you to rent out your property for shorter periods, potentially generating higher returns than traditional year-long leases.

However, this approach comes with additional management responsibilities.

Value Appreciation

It is important to consider the appreciation in a property's value and the increased equity it holds as a result.

This allows you to sell the property at a profit later down the line or use the equity held in the property to borrow more funds and maintain or grow your portfolio.

[4]

Control and Flexibility:

Tailoring Your Investment to Your Goals

Unlike stocks where you're subject to market fluctuations, real estate offers a greater degree of control.

You can choose to manage your properties directly, allowing you to personalise your approach and potentially save on management fees.

Alternatively, you can hire professional property management services, freeing up your time and ensuring your properties are well-maintained.

This flexibility empowers you to tailor your investment strategy to your specific goals and risk tolerance.

[5]

Building a Legacy:

Passing on Wealth Through Property

A well-managed property portfolio has the potential to become a valuable asset that transcends generations.

By establishing a holding company or trust, you can pass your portfolio down to your heirs, creating a lasting legacy that provides them with financial stability and a head start on their own wealth-building journey.

One advantage of using a company to purchase and maintain property is the ability to offset all expenses (renovations, repairs, loan & mortgage debt) against profits made from rental income.

[6]

The 'Grant Cardone' Method:

Building an Empire from Scratch

Grant Cardone's rags-to-riches story exemplifies the transformative power of property investment.

Starting with limited resources, he built a billion-dollar real estate empire through a unique and aggressive approach.

Here are the core principles that define the Grant Cardone method:

Leverage: Debt as a Tool, Not a Burden

Cardone emphasises the strategic use of debt to fuel growth.

He views debt as a tool to acquire more income-producing properties.

The rental income generated from these properties ultimately covers the debt and generates a profit.

However, it's crucial to note that this approach requires careful planning and a strong understanding of your financial capabilities.

Cashflow is King

While property appreciation is important, Cardone prioritises cash flow.

Rental income provides the lifeblood of his investment strategy, allowing him to reinvest profits and expand his portfolio.

This focus on cash flow ensures a steady stream of income, even when the market experiences downturns.

Selling is for Suckers

Cardone's philosophy centres around building a portfolio that generates income and appreciates over time.

Selling disrupts this growth cycle. Instead, he focuses on holding onto properties and leveraging their cash flow for further investment.

This buy-and-hold approach allows him to benefit from long-term appreciation and build a sustainable wealth machine.

Cardone in Today's Market:

Adapting the Approach for Continued Success

The real estate market is a dynamic landscape, and Grant Cardone, ever the astute investor, would undoubtedly adapt his approach to the current climate.

Here's how his core principles might translate into action in today's environment:

Strategic Leverage

While Cardone advocates for leverage, he wouldn't blindly jump into debt.

In today's market with rising interest rates, he would likely emphasise securing loans with favourable terms to ensure positive cash flow remains paramount.

This might involve focusing on fixed-rate mortgages to avoid potential fluctuations in monthly payments.

Data-Driven Decisions

The abundance of real estate data readily available online empowers investors to make informed decisions.

Cardone would leverage this data to identify investment opportunities in areas with strong rental markets, stable job growth, and a projected increase in property values.

This data-driven approach minimises risk and maximises the potential for long-term success.

Embrace Technology

Technology has revolutionised the real estate industry.

Cardone would likely utilise online property management platforms to streamline tenant screening, rent collection, and maintenance requests.

Additionally, he might explore virtual tours and online marketing strategies to attract a wider pool of qualified tenants, minimising vacancy periods and maximising rental income.

Focus on Value Investing

In a competitive market, identifying undervalued properties becomes crucial.

Cardone might adopt a value investing strategy, seeking properties with potential for renovation or those located in up-and-coming neighbourhoods.

By adding value through strategic renovations or capitalising on neighbourhood improvement initiatives, he could unlock significant equity and generate substantial returns.

Community Building

Building strong relationships with tenants fosters long-term occupancy and reduces turnover.

Cardone might implement initiatives that create a sense of community within his rental properties, such as organising social events or offering tenant referral programs.

This not only fosters loyalty but also attracts high-quality tenants willing to pay premium rent.

Why Your Home Isn't an Asset

(& What You Should Buy Instead)

Robert Kiyosaki, another prominent figure in financial education, famously refers to a primary residence as a liability, not an asset.

This is because it drains cash flow through mortgage payments, property taxes, and maintenance costs.

While owning a home can be a personal goal, from an investment perspective, it doesn't generate income.

Instead, Kiyosaki emphasises the importance of acquiring assets that put money in your pocket, such as income-generating real estate.

[7]

Beyond Single-Family Homes:

Exploring Alternative Investment Options

While single-family homes are a traditional choice for property investment, the market offers a variety of alternatives worth considering:

Multi-Unit Properties

Owning a duplex, triplex, or even a small apartment building allows you to generate income from multiple tenants, potentially increasing your cash flow and overall return on investment.

Commercial Properties

Investing in commercial properties like office buildings, retail spaces, or warehouses can provide a steady stream of income from established businesses.

However, commercial properties often require a larger initial investment and carry different management considerations compared to residential properties.

Real Estate Investment Trusts (REITs)

REITs allow you to invest in a portfolio of real estate assets without the hassle of directly managing properties.

This provides diversification and liquidity but may offer lower overall returns compared to directly owning and managing real estate.

Taking Action:

Your Path to Property Investment Success

Now that you're armed with the knowledge of the power of property investment, it's time to take action.

Here are some initial steps to get you started:

Educate Yourself

Knowledge is power.

Devour books, articles, and podcasts on real estate investing.

Consider attending workshops or seminars to gain practical insights from experienced investors.

Define Your Goals

What do you hope to achieve through property investment?

Is it generating passive income, building long-term wealth, or achieving early retirement?

Clearly defined goals will guide your investment strategy.

Determine Your Budget

Carefully assess your financial situation and determine how much you can realistically invest in a property.

Consider factors like down payment, mortgage payments, property taxes, and potential renovation costs.

Explore Your Market

Research different neighbourhoods and property types to identify areas with strong rental demand and potential for appreciation.

Seek Professional Advice

Consulting with a qualified real estate agent and financial advisor can be invaluable.

They can help you navigate the complexities of the market, identify suitable properties, and develop a personalised investment strategy.

Additional Tips

Here are some additional tips to keep in mind should you decide to explore the potential of property investing:

Start Small and Scale Up

You don't need to start with a multi-million-dollar property.

Begin with a manageable investment, such as a single-family home or a small apartment.

As you gain experience and your cash flow grows, you can gradually scale up your portfolio and explore more complex investment opportunities.

Be Patient and Persistent

Building wealth through real estate doesn't happen overnight.

There will be challenges along the way, from finding the right property to dealing with unexpected repairs.

However, with patience, persistence, and a commitment to your long-term goals, you can overcome these obstacles and achieve success.

Network with Other Investors

Surround yourself with positive and like-minded individuals who share your passion for real estate.

Joining investor groups or attending conferences allows you to learn from their experiences, share best practices, and potentially discover new investment opportunities.

Stay Up To Date on Market Trends

The real estate market is constantly evolving.

Regularly reading industry publications, attending webinars, and keeping yourself informed about economic forecasts allow you to adapt your strategy as needed and capitalise on emerging trends.

Conclusion

Property investment has the power to transform your financial future.

By understanding its advantages, adopting a strategic approach, and taking consistent action, you can build a portfolio that generates wealth for future generations.

Remember, cash flow is king, debt can be a powerful tool when used wisely, and your home, while a personal sanctuary, may not be the best investment option.

Embrace the power of property investment, and embark on a journey towards financial freedom and long-term prosperity.